Partial Real Estate Investment: Dubai Market Analysis

Partial real estate investment has emerged as a key access point for investors in Dubai’s 2025 property market. The fractional model allows you to acquire a share of a property rather than the whole asset, lowering entry cost and improving diversification. In the UAE, fractional ownership is gaining traction: recent data points to a strong rise in participation from younger global investors.

Dubai’s regulatory environment supports this shift. Platforms now operate under licensed Special Purpose Vehicles (SPVs) and escrow-protected structures. These features bring real legal ownership and transparency to fractional investors. With premium districts priced beyond many buyers’ reach, partial real estate investment offers a practical route into high-quality real estate in Dubai.

In the sections that follow you will explore what this model means for the Dubai market, how it compares to full ownership, and where your opportunity lies in 2025’s evolving landscape.

What Partial Real Estate Investment Means for Dubai

Partial real estate investment is opening Dubai’s property market to a wider investor base. Instead of purchasing an entire unit, investors buy fractional shares in managed assets, reducing capital requirements while maintaining legal ownership rights.

This shift supports Dubai’s strategy to attract international capital and expand participation in the real estate sector. As of now, property transactions continue to grow, signalling strong demand across multiple ownership structures.

The model aligns with the city’s long-term goals by making property ownership accessible to both individual and institutional investors. It offers flexibility for those seeking exposure to several asset classes while maintaining transparency through regulated frameworks.

With the foundation set, the next section looks at why partial real estate investment is gaining pace in 2025 and what is driving its continued expansion.

Why the Model Is Gaining Momentum

The rise of partial real estate investment in Dubai reflects a shift in how investors view property ownership. With rising property prices and tighter lending conditions, many buyers now prefer accessible entry routes that allow participation without full capital outlay.

For individual investors, the appeal lies in flexibility. Buying a share in a property makes it possible to diversify across several developments instead of committing to one large asset. This spreads risk and opens exposure to different districts, property types, and rental profiles.

Institutional and family office investors see similar advantages. Fractional models simplify portfolio allocation, enabling partial stakes in high-yield or premium properties that were previously beyond reach. The structure also supports long-term strategies by linking ownership to actual asset performance rather than speculation.

The concept fits neatly within Dubai’s ongoing move toward regulated and transparent investment options. As more developers and licensed platforms introduce fractional models, investor participation continues to widen.

The next section compares partial real estate investment to traditional property models, showing how the two approaches differ in ownership, cost, and return potential.

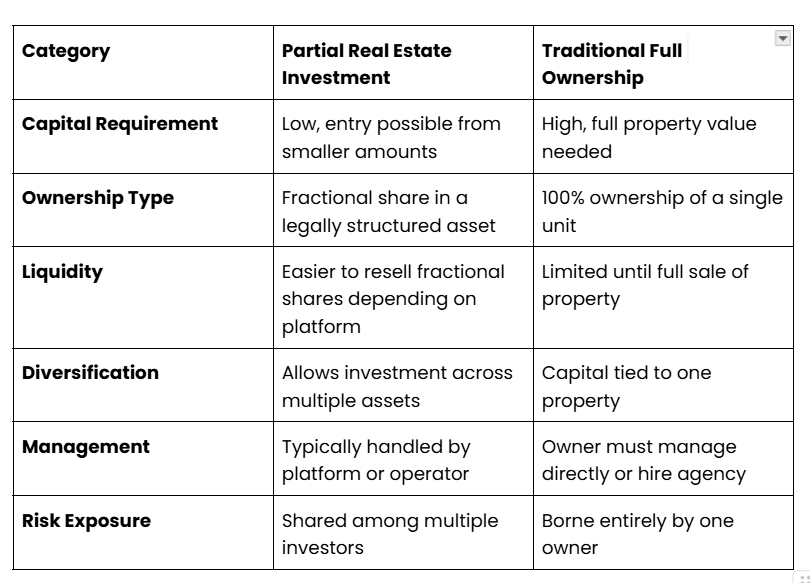

When reviewing investment options, partial real estate investment stands out for its flexibility and lower entry cost compared to full ownership. Each model has its own benefits and limitations depending on budget, liquidity, and control.

Here’s a simple comparison overview:

This comparison shows how partial real estate investment gives you the flexibility to access prime properties without heavy financial commitment. It also reduces concentration risk, making it easier to maintain balanced exposure in Dubai’s fast-growing market.

While traditional ownership still appeals to buyers seeking full control, partial models appeal to investors prioritising access, diversification, and liquidity. The next section looks at how current market trends in 2025 are shaping demand for both options and what that means for future returns.

Market Outlook and Key Trends for 2025

The demand for partial real estate investment in Dubai continues to strengthen as investors look for flexible, transparent, and lower-cost entry options. Developers are responding with more structured models that allow fractional ownership in both residential and commercial assets.

Rising interest from international investors is another key trend. Many now view Dubai as a stable market offering consistent returns and strong regulation, supported by clear ownership frameworks.

Technology-led investment platforms are also helping investors manage portfolios more efficiently, improving visibility and access to high-performing properties.

While the outlook remains positive, investors still need to consider governance, liquidity, and management efficiency before participating. These aspects are discussed further in the following section.

Challenges and Risk Considerations

Every partial real estate investment comes with structural and market risks that should be reviewed before entering an agreement.

Liquidity is one of the main concerns. Selling a fractional share may take longer than selling a full property, especially if market demand slows. Understanding exit procedures and secondary market options is essential.

Governance and transparency also matter. Investors should confirm that all projects operate under regulated entities, with clear legal documentation and escrow-backed transactions.

Operational risks can arise if the property is not managed effectively. Regular reporting, maintenance standards, and rental collection procedures must be consistent to protect returns. Recognising these challenges allows investors to make informed choices and focus on platforms that maintain strong compliance and asset management practices.

The following section highlights how JODOA addresses these requirements through structured participation and verified project access.

Building Confidence in Partial Real Estate Investment

Partial real estate investment gives investors a direct, regulated way to participate in Dubai’s growing property market without the cost of full ownership. It offers access to prime locations, income potential, and long-term appreciation through structured participation.

Platforms such as JODOA help make this possible by screening developments, managing compliance, and providing transparent updates from purchase to payout. Investors benefit from clear documentation, escrow-backed transactions, and professional oversight across each stage.

With a well-defined process and increasing market maturity, Dubai continues to stand out as one of the most attractive destinations for shared property ownership.

If you are ready to see the latest opportunities, review verified projects through JODOA and learn how partial ownership can fit into your investment strategy.

Social Share:

Social Share: